Bank of America Uses Which Credit Bureau Mostly

The outlier if any could be the one to change approval to a denial. But the most recent data points suggest that they will.

How To Get Bank Of America Personal Loans 2022 Mybanktracker

TD BANK AMERICAS MOST CONVENIENT BANK 600 PASSAIC AVENUE West Caldwell NJ 07006.

. Its important that you know which credit bureau a particular bank uses in its credit pulls since. Bank of America has an application rule called 234. Bank of America.

82515 221 PM EDT By Chris Morran themorrancave. WELLS FARGO BANK 813 BLOOMFIELD AVE West Caldwell NJ 07006. The most important credit bureau or score when buying a house is the one your lender will utilize to change an underwriting decision for a loan application.

That varies based on the state you reside in. What a credit bureau does. Citi uses all three credit bureaus but usually pulls credit reports from Equifax or Experian.

There is no clear-cut answer to the most used credit bureau. Insurance Products are offered through Merrill Lynch Life Agency Inc. We value their proven long-term stability and the reliability of their data helps us.

This is up about 81 from the year-ago quarter. Bank may win on this front. Bank of America offers every retail bank product you can imaginemortgage loans student debt payments credit and debit cards financial advisingat higher qualities than most of its competitors.

AFCU Amex Chase PSECU EX 98. The segment generated the most revenue across all segments accounting for 89 billion in revenue. However as many users report US.

What credit reporting agency does Bank of America use. Looks like in most states that Experian will be used although occasionally your TransUnion or Equifax report will be used instead. Weve done this for Citi American Express Chase before so now its Bank of Americas turn.

Thats because revenues stem from many sources. Specifically the card issuer does a hard pull inquiry of your credit report from its favored credit bureau when it receives your application. Credit bureaus also assign you a credit score or more than one credit score most likely the FICO score or the VantageScore.

For the real thing often EX sometimes TU but probably varies by location. But authorized users dont pay the bill and the bank doesnt hold them accountable for it which is the danger anyone risks by putting someone on as an authorized user. It is the second.

Chase uses all three credit bureaus but favors Experian yet may also buy Equifax or TransUnion reports. However we can get some hints by comparing the 2018 revenues of all three. Barclays Across our lending products Barclays utilizes all of the top three credit bureaus representative George Caudill says.

Anytime a consumer uses a bank product or service that involves loan repayment that information is collected into his or her credit report. American Express uses all three credit bureaus but primarily pulls reports from Experian though sometimes Equifax or TransUnion as well. American Express says it pulls reports from all three credit bureaus.

The account is based off of the primary account holders credit score and history and authorized users are exactly that -- authorized to use the account. According to the Credit Pulls Database Bank of America seems to pull predominantly from Experian and TransUnion but occasionally from Equifax. 26 rows Bank of America is most likely to check your Experian credit report when you submit a.

Bank of America match-up US. Bank is most likely to use your TransUnion credit report when considering your credit card application for approval. Here are 19 things everybody should know about Bank of America when it comes to their credit cards.

Examples of these activities include student loans revolving credit accounts car loans mortgages credit card transactions and bankruptcy filings. Which Credit Bureau does Bank of America use. MLLA andor Banc of America Insurance Services Inc both of which are licensed insurance agencies and wholly-owned subsidiaries of Bank of America Corporation.

There is mixed reports with Bank of America some say they will pull another report if yours is frozen and other say they wont. The Bank of America Corporation commonly referred to as Bank of America. Credit bureaus for consumer credit data.

The FICO score is particularly important and useful since 90 percent. In the case of a major credit application such as a mortgage all three bureaus are pulled in what is known as a Tri-Merge Report. Bank can pull your credit data from any of the three major US.

Supports EMV chips on credit cards. MONEY ACCESS SERVICE 599 PASSAIC AVE West Caldwell NJ 07006. DCU EQ 50 Citi EQ 08 Bankcard PenFed EX NG2.

Therefore its extremely important to check your TransUnion. Bank of America pulls information from all three major credit bureaus TransUnion Equifax and Experian. All credit card issuers choose among the three credit bureaus Experian TransUnion and Equifax as the primary source of credit history reports when you apply for a card.

Bank of America says it uses reports from all three credit bureaus. You can use the database to search for recent credit pulls by Bank of America in. Banking credit card automobile loans mortgage and home equity products are provided by Bank of America NA.

Which credit bureaus FICO score is used by lenders most frequently. Because of the large loan amounts mortgage companies typically use all three bureau reports. While these numbers are suggestive they certainly arent definitive.

Theyll only approve you for at most two cards per rolling 2 months three cards per rolling 12 months and four cards. Although there are a number of credit bureaus in the United States the big three are Experian TransUnion and EquifaxWhile each bureau essentially does the same thing they are in competition with one another and thus have their own set of unique products and services. Consumer Banking net income rose 207 YOY to.

They pull EQ soft if you app at their preapproval site. Often abbreviated as BofA or BoA is an American multinational investment bank and financial services holding company headquartered in Charlotte North CarolinaThe bank was founded in San Francisco and took its present form when NationsBank of Charlotte acquired it in 1998. Credit Bureaus Bank Of America Wells Fargo Top List Of Most Complained-About Financial Companies.

Small Business Owners Less Satisfied With Credit Card Issuers Mostly Due To Lack Of Communication Travel Rewards Credit Cards Credit Repair Credit Card

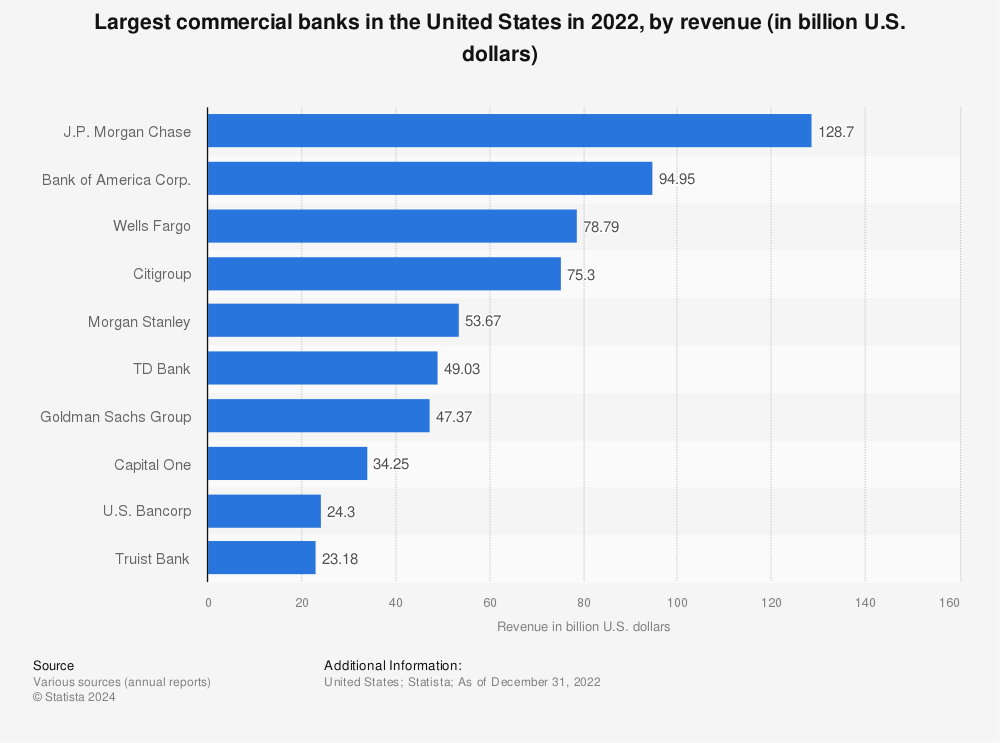

Top Commercial Banks In The U S By Revenue 2020 Statista

Bank Statements Credit Card Statement Statement Template Bank Statement

No comments for "Bank of America Uses Which Credit Bureau Mostly"

Post a Comment